A 46-year-old Leesburg man is in jail for allegedly depositing fraudulent checks from his deceased grandfather’s bank account into his own account.

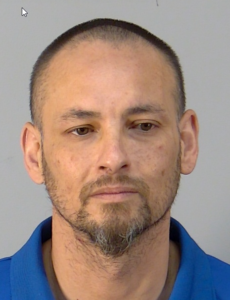

Daniel William Habel, 46, of 8624 Silver Trail, was charged last week with five counts of criminal use of personal information, six counts of depositing a worthless check with intent to defraud, and single counts of scheming to defraud (less than $20,000), and grand theft ($5,000 to $10,000).

On March 2, a corporate investigator with Truist Bank contacted the Lake County Sheriff’s Office to report that between Oct. 30 and Nov. 2, 2021, Habel had deposited six fraudulent checks into his Truist account through ATM and mobile deposits. Habel then withdrew the money from his account, leaving a negative balance of $4,197.45, which is the financial loss suffered by Truist Bank, according to the sheriff’s office report.

Habel was the suspect due to the checks being deposited into his account. His username and password were required to conduct the mobile deposits. Habel had not reported any fraudulent activity to his account and he failed to respond to two demand letters from Truist giving him 10 days to arrange for the repayment of the money, the report said.

Habel’s grandfather died in May 2017. Four of the fraudulent checks were from a Wells Fargo account in Habel’s grandfather’s name and had his grandfather’s signature. Two of the checks were from a joint account at Floridian Bank (now Seacoast) held by Habel’s grandfather and his grandfather’s stepson, who was a financial caretaker. Those checks were signed by the stepson, who had no knowledge of the transactions and wanted to press charges against Habel, according to the report.

The Truist investigator provided video of the ATM transactions where Habel could be identified, as well as copies of checks and bank statements implicating him, the report said.

Habel was arrested at his home on April 25 and taken to the Lake County Jail, where he’s being held on $28,000 bond. He’ll answer to the charges in Lake County Court on May 23.